International software development has become the norm rather than the exception, with 67% of development teams working with clients across multiple countries and currencies. Managing time tracking and billing across different currencies presents unique challenges that can impact cash flow, client relationships, and business profitability if not handled properly.

Many development teams struggle with currency conversion accuracy, billing transparency, and maintaining professional standards across international clients. Manual currency calculations often lead to errors, disputes, and lost revenue, while clients expect billing in their local currency with transparent exchange rate documentation. For teams serving global markets, understanding how to create professional client billing timesheets is essential for international success.

This comprehensive guide will teach you how to set up multi-currency time tracking for international clients, covering automated currency conversion, professional billing practices, and tools that eliminate the complexity of global business while maintaining accuracy and client trust.

What You'll Learn

- How to configure automated multi-currency time tracking systems

- Best practices for currency conversion and exchange rate management

- Professional billing strategies for international client relationships

- Tools and techniques for accurate cross-border financial reporting

- Methods to handle complex international billing scenarios and compliance

Understanding Multi-Currency Time Tracking Challenges

Multi-currency time tracking involves more than simple currency conversion—it requires understanding international business practices, currency volatility, and client expectations across different markets.

Common International Billing Challenges

Currency Conversion Complexity

- Exchange Rate Volatility: Daily fluctuations can significantly impact project profitability

- Rate Timing Issues: Different rates at contract signing vs. invoice generation

- Conversion Accuracy: Manual calculations lead to errors and client disputes

- Multi-Currency Project Management: Tracking multiple currencies simultaneously

Client Communication Issues

- Rate Transparency: Clients need clear understanding of conversion methods

- Billing Clarity: International invoices must be professional and compliant

- Payment Processing: Different payment methods and processing times by country

- Tax and Compliance: VAT, GST, and other international tax considerations

Business Impact

- Cash Flow Variation: Currency fluctuations affect revenue predictability

- Profitability Risk: Unfavorable rate changes can eliminate project margins

- Administrative Overhead: Manual currency management increases costs

- Client Relationship Strain: Currency disputes damage business relationships

Prerequisites and Requirements

Before implementing multi-currency time tracking, ensure you have the necessary foundation:

Essential Requirements

- Client Currency Documentation: Clear understanding of each client's preferred billing currency

- Exchange Rate Data Source: Reliable, real-time currency conversion service

- Professional Billing System: Tools capable of multi-currency invoicing and reporting

- Compliance Knowledge: Understanding of international tax and business regulations

Recommended Tools

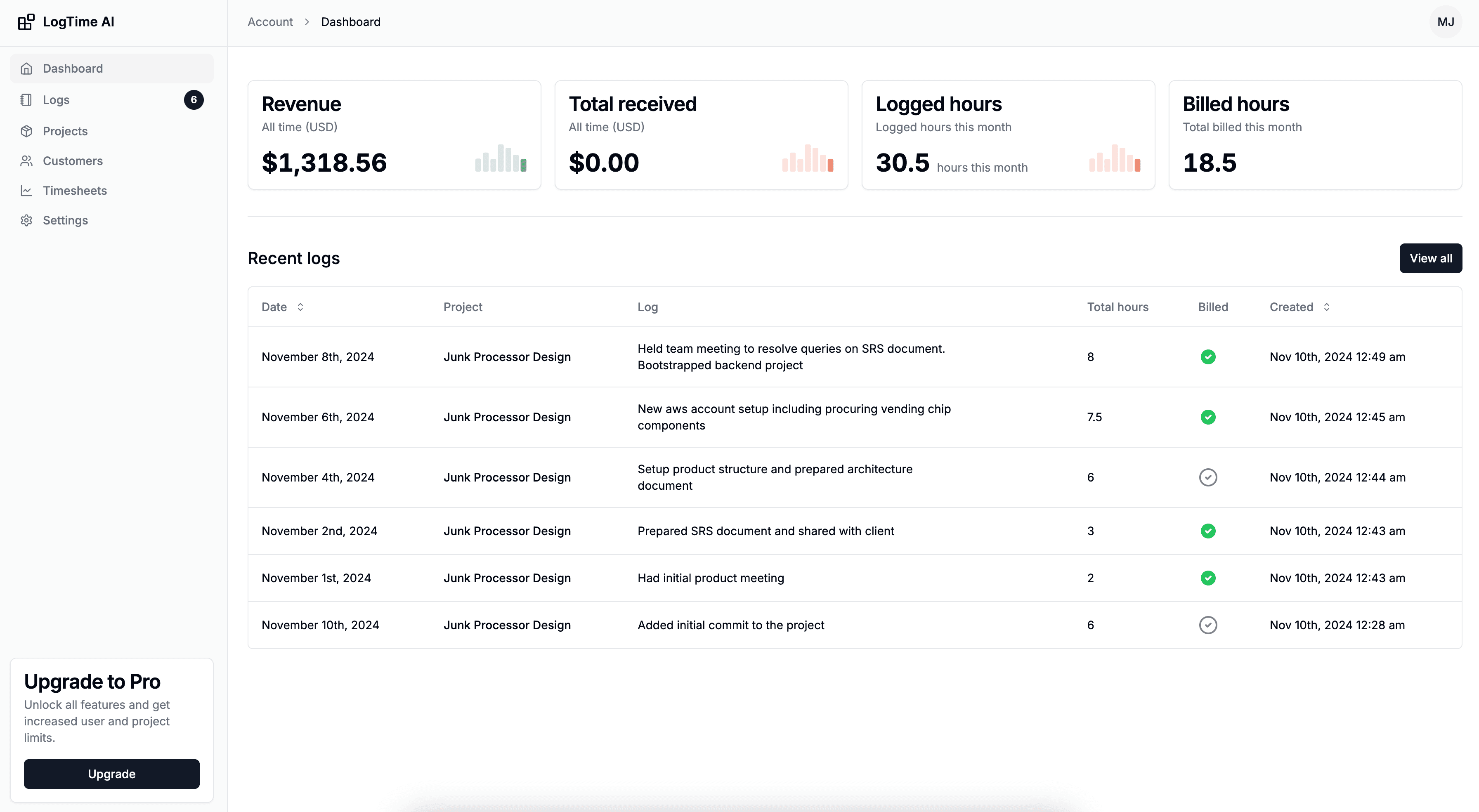

- LogTime.ai: For automated multi-currency time tracking with real-time conversion

- Currency API Service: For accurate, up-to-date exchange rate data

- International Banking: Multi-currency business accounts for payment processing

- Accounting Software: International-capable financial management system

Time Investment

- Initial Setup: 4-6 hours for multi-currency configuration and testing

- Client Communication: 1-2 hours per client for currency preference setup

- Process Implementation: 1-2 weeks for workflow optimization

- Ongoing Management: 30-60 minutes weekly for rate monitoring and adjustment

Skill Level

This guide is designed for businesses with basic international commerce knowledge. We'll provide detailed instructions for all technical and financial setup requirements.

Step-by-Step Guide: How to Set Up Multi-Currency Time Tracking

Step 1: Configure Multi-Currency Foundation

The foundation of successful international time tracking is a robust multi-currency system that handles conversion, documentation, and reporting automatically.

What You'll Do

- Set up automated currency conversion system

- Configure client-specific currency preferences

- Establish exchange rate documentation and auditing

- Create professional multi-currency reporting templates

Why This Step Matters

Automated multi-currency handling eliminates manual calculation errors, provides transparent rate documentation, and ensures professional presentation that builds international client trust.

Implementation with LogTime.ai

1. Multi-Currency Account Configuration

// LogTime.ai multi-currency setup

Organization Settings:

Base Currency: USD (your business currency)

Supported Currencies: [USD, EUR, GBP, CAD, AUD, JPY, CHF]

Exchange Rate Source: Real-time API

Rate Update Frequency: Daily at 9:00 AM UTC

Default Settings:

Rate Documentation: Enabled

Historical Rates: 24-month retention

Client Notifications: Currency rate changes > 5%2. Client-Specific Currency Configuration

// Example client currency setup

Client: TechCorp EU

Billing Currency: EUR

Rate Timing: Contract signing date

Rate Lock: 30-day projects

Conversion Display: Always show USD equivalent

Client: StartupUK Ltd

Billing Currency: GBP

Rate Timing: Invoice generation date

Rate Lock: No (real-time conversion)

Conversion Display: Hide USD (GBP only)3. Exchange Rate Integration

# Configure real-time exchange rate API

API Provider: European Central Bank + Forex API

Update Schedule: Daily at market close

Backup Source: Bank exchange rates

Audit Trail: All rate changes logged with timestampCommon Mistakes to Avoid

- Using Static Exchange Rates: Always use current, market-accurate rates

- Inconsistent Rate Sources: Use reliable, auditable exchange rate providers

- Poor Rate Documentation: Document all conversion rates for client transparency

Pro Tips

- Set up rate change alerts for significant currency movements (>5%)

- Use forward contracts for large, long-term projects to hedge currency risk

- Configure automatic rate locks for fixed-price international projects

Step 2: Implement Professional Multi-Currency Billing

Professional international billing requires clear currency documentation, transparent conversion methodology, and compliance with international business standards.

Advanced Configuration

1. Currency Display and Documentation

// Professional timesheet currency display

Header Section:

Primary Amount: €1,250.00 EUR

Conversion Rate: 1 EUR = 1.0850 USD (as of 2025-03-10)

USD Equivalent: $1,356.25 USD

Rate Source: European Central Bank

Work Details:

Development: 10.0 hours × €125/hour = €1,250.00

Footer:

"Exchange rates updated daily at 9:00 AM UTC"

"Rate locked for invoices issued within 24 hours"2. Multi-Currency Project Tracking

// Complex international project example

Project: Global E-commerce Platform

Development Team: Multiple countries

Client: International Corp (USD)

Team Rates by Location:

US Developer: $150/hour

UK Developer: £120/hour (→ $146.40 USD)

EU Developer: €130/hour (→ $141.05 USD)

Blended Rate Calculation:

Weighted Average: $147.25/hour USD

Client Billing: $150/hour USD (simplified)

Margin Protection: 1.9% currency bufferTools That Help

LogTime.ai excels at multi-currency billing by providing:

- Real-Time Currency Conversion: Automatic, market-accurate exchange rates

- Professional Documentation: Clear rate sources and conversion methodology

- Historical Rate Tracking: Complete audit trail for all currency conversions

- Client-Specific Preferences: Customizable currency display and billing options

Implementation Example

// LogTime.ai multi-currency workflow

1. Time Tracking:

- Developer commits tracked automatically

- Hours logged in base currency (USD)

- AI estimates time based on code complexity

2. Currency Conversion:

- Client currency applied automatically (EUR)

- Real-time exchange rate retrieved

- Conversion documented and audited

3. Professional Reporting:

- Timesheet generated in client currency

- Exchange rate and source documented

- USD equivalent shown for transparencyStep 3: Handle Complex International Billing Scenarios

Real-world international development involves complex scenarios requiring sophisticated currency management and billing strategies.

Multi-Region Development Teams

// Example: Global development team billing

Project: Mobile Banking App

Client: FinTech Corp (GBP)

Team Distribution:

UK Team Lead: £140/hour

- Project management: 8 hours

- Architecture review: 4 hours

- Total: £1,680 (12 hours)

US Backend Developer: $165/hour

- API development: 20 hours

- Database optimization: 8 hours

- Total: $4,620 (28 hours) → £3,782.61 GBP

EU Frontend Developer: €145/hour

- UI development: 24 hours

- Mobile optimization: 6 hours

- Total: €4,350 (30 hours) → £3,765.45 GBP

Consolidated Client Bill:

Total Hours: 70 hours

Total Amount: £9,228.06 GBP

Average Rate: £131.83/hour GBPFixed-Price vs. Time-and-Materials Currency Handling

// Fixed-price project currency strategy

Project Type: Fixed-Price Website

Contract Value: €50,000 EUR

Exchange Rate at Signing: 1 EUR = 1.0825 USD

USD Equivalent: $54,125

Currency Risk Management:

Rate Lock Period: 6 months

Hedge Strategy: Forward contract at 1.0800

Risk Buffer: 2.3% margin protection

Monthly Billing:

Month 1: €10,000 (20% complete)

Month 2: €15,000 (50% complete)

Month 3: €12,500 (75% complete)

Month 4: €12,500 (100% complete)

Rate Protection: Fixed at contract rate regardless of market changesRetainer and Support Currency Management

// International support retainer

Client: GlobalTech (AUD)

Support Package: 20 hours/month

Rate: AUD $200/hour

Monthly Value: AUD $4,000

Quarterly Billing Cycle:

Q1 Rate Average: 1 AUD = 0.6825 USD

Q1 USD Value: $2,730 per month

Q2 Rate Average: 1 AUD = 0.7150 USD

Q2 USD Value: $2,860 per month

Rate Adjustment Strategy:

Quarterly rate review

Automatic adjustment for >10% variance

Client notification for rate changesLogTime.ai Advanced Multi-Currency Features

- Automated Team Rate Blending: Calculates weighted averages across multiple currencies

- Currency Risk Alerts: Notifications for significant rate changes affecting profitability

- Historical Rate Analysis: Trend analysis for optimal rate lock timing

- Compliance Reporting: Automated documentation for international tax requirements

Step 4: Implement Currency Risk Management

Professional international development requires strategies to manage currency volatility and protect business profitability.

Currency Hedging Strategies

1. Forward Contracts for Large Projects

// Example: Large fixed-price project hedging

Project: Enterprise Software Development

Contract Value: €250,000 EUR

Project Duration: 12 months

Current Rate: 1 EUR = 1.0850 USD

Hedging Strategy:

Forward Contract: Lock €250,000 at 1.0800 USD

Hedge Coverage: 80% of project value

Protected USD Value: $216,000 (80% of $270,000)

Risk Analysis:

Unhedged Risk: $54,000 (20% exposed)

Maximum Loss: $5,400 (10% adverse move)

Hedge Cost: $750 (0.3% of contract value)2. Natural Hedging Through Expenses

// Natural hedge example

Revenue Exposure:

UK Client: £50,000/year

EU Client: €75,000/year

Expense Matching:

UK Developer: £35,000/year salary

EU Contractor: €45,000/year

Natural Hedge Effect:

UK: 70% revenue hedged by local expenses

EU: 60% revenue hedged by local expenses

Net Exposure: 35% of total international revenuePricing Strategies for Currency Protection

// Currency buffer pricing

Base Development Rate: $150/hour USD

International Rate Calculation:

Currency Risk Buffer: 3%

Payment Processing: 2%

Administrative Overhead: 1%

Total Buffer: 6%

International Rates:

EUR Clients: €140/hour (includes 6% buffer)

GBP Clients: £125/hour (includes 6% buffer)

AUD Clients: AUD $220/hour (includes 6% buffer)Step 5: Establish Professional International Communication

Professional international client relationships require clear communication about currency policies, rate changes, and billing procedures.

Client Onboarding for Multi-Currency

1. Currency Preference Documentation

// Client currency preference template

Client Onboarding Form:

Preferred Billing Currency: [EUR/GBP/USD/Other]

Rate Lock Preference: [Daily/Weekly/Monthly/Project]

Conversion Transparency: [Show/Hide USD equivalent]

Payment Currency: [Same as billing/Different]

Invoice Requirements:

Tax Registration: [VAT/GST number if applicable]

Currency Rounding: [Standard/Client preference]

Rate Documentation: [Detailed/Summary]2. Professional Rate Change Communication

Subject: Currency Rate Update - Project [Name]

Dear [Client Name],

We're writing to inform you of exchange rate changes that may affect your upcoming invoice.

Current Project Details:

- Project: E-commerce Platform Development

- Your Currency: EUR

- Our Base Currency: USD

Rate Information:

- Previous Rate: 1 EUR = 1.0825 USD (Invoice #2024-089)

- Current Rate: 1 EUR = 1.0950 USD (Invoice #2024-090)

- Rate Change: +1.15% (favorable to you)

Impact on Your Invoice:

- Previous Rate Billing: €1,385.32

- Current Rate Billing: €1,369.86

- Difference: €15.46 savings

Our currency rates are updated daily using European Central Bank data to ensure accuracy and fairness for all clients.

If you have any questions about our currency policies, please don't hesitate to reach out.

Best regards,

[Your Name]Professional Invoice Presentation

// Multi-currency invoice template

INVOICE #2025-034

Bill To: TechStart GmbH

Currency: EUR

Exchange Rate: 1 EUR = 1.0875 USD (ECB, 2025-03-10)

Work Performed: February 1-28, 2025

Development Services:

Backend API Development: 32.0 hours × €125/hour = €4,000.00

Database Optimization: 8.0 hours × €125/hour = €1,000.00

Code Review & Testing: 6.0 hours × €125/hour = €750.00

Subtotal: €5,750.00

VAT (19%): €1,092.50

Total Due: €6,842.50

USD Equivalent: $7,441.22 (for reference only)

Payment Terms: Net 30 days

Payment Methods: SEPA transfer, international wire

Currency: Payment must be in EURValidation and Success Metrics

You'll know your multi-currency system is successful when:

- Zero currency calculation errors in client billing

- Reduced payment delays due to clear currency documentation

- Improved client satisfaction with professional international presentation

- Protected profit margins through effective currency risk management

Best Practices for Multi-Currency Time Tracking

Do's

- Use Real-Time Exchange Rates: Always use current, market-accurate rates from reliable sources

- Document Rate Sources: Provide clear documentation of exchange rate sources and timing

- Implement Consistent Policies: Establish clear currency policies and communicate them to clients

- Monitor Currency Risk: Track exposure and implement hedging strategies for large projects

Don'ts

- Avoid Manual Currency Calculations: Manual conversions lead to errors and disputes

- Don't Ignore Rate Volatility: Significant currency movements require proactive management

- Avoid Inconsistent Rate Timing: Use consistent rate timing (daily, invoice date, etc.)

- Don't Hide Conversion Details: Transparency builds trust with international clients

Advanced Strategies

Once you've established basic multi-currency operations, consider these advanced approaches:

Strategy 1: Dynamic Currency Pricing

// Dynamic pricing based on currency strength

Base Rate: $150/hour USD

Currency Strength Analysis:

USD Strong (+5% vs. basket): Offer 2% discount to EUR/GBP clients

USD Weak (-5% vs. basket): Maintain standard rates

Implementation:

Quarterly rate reviews

Automatic client notifications

Competitive positioning maintenanceStrategy 2: Currency Portfolio Management

// Portfolio approach to currency exposure

Total International Revenue: $500,000/year

Currency Mix Target:

EUR: 40% ($200,000)

GBP: 30% ($150,000)

AUD: 20% ($100,000)

Other: 10% ($50,000)

Rebalancing Strategy:

Monthly exposure analysis

New client targeting based on currency needs

Rate adjustments to encourage/discourage currenciesStrategy 3: Automated Risk Management

// Automated currency risk alerts

Risk Thresholds:

Daily Movement: >3% triggers alert

Weekly Movement: >7% triggers hedging review

Monthly Movement: >15% triggers rate renegotiation

Automated Actions:

Email alerts to finance team

Client notification for significant rate changes

Automatic hedge recommendations

Profitability impact analysisAutomation Opportunities

LogTime.ai provides comprehensive automation for multi-currency operations:

- Real-Time Rate Updates: Automatic exchange rate retrieval and application

- Professional Documentation: Automated rate source and timing documentation

- Risk Monitoring: Automated alerts for currency movements affecting profitability

- Client Communication: Automated notifications for rate changes and billing updates

Common Challenges and How to Overcome Them

Challenge 1: Currency Volatility Impact on Profitability

Problem: Exchange rate fluctuations erode project margins Solution: Implement hedging strategies and currency buffers in pricing LogTime.ai Advantage: Real-time risk monitoring and profitability alerts

Challenge 2: Client Confusion About Currency Conversions

Problem: Clients question conversion rates and billing accuracy Solution: Provide transparent rate documentation and clear communication Tools That Help: Automated rate source documentation and historical tracking

Challenge 3: Complex Multi-Team Currency Coordination

Problem: Teams in different countries with different local rates Solution: Automated rate blending and professional presentation to clients Expert Tip: Use weighted averages and transparent rate documentation

Challenge 4: Compliance and Tax Implications

Problem: International tax and reporting requirements vary by country Solution: Maintain detailed records and consult with international tax professionals Prevention: Use tools that provide comprehensive audit trails and documentation

When to Seek Help

Consider professional assistance when:

- Currency exposure exceeds 20% of total revenue

- Rate volatility significantly impacts project profitability

- Compliance requirements are complex in target markets

- Client disputes arise regarding currency conversions

Resources for Additional Support

- LogTime.ai Support: Multi-currency setup and optimization assistance

- International Banking: Multi-currency account setup and management

- Tax Professionals: International compliance and reporting guidance

- Currency Hedging Services: Professional risk management solutions

Measuring Success

Key Performance Indicators (KPIs)

Track these metrics to measure multi-currency success:

- Currency Conversion Accuracy: Zero calculation errors in client billing

- Payment Speed: Average time from invoice to payment by currency

- Profitability Protection: Maintained margins despite currency volatility

- Client Satisfaction: Reduced currency-related disputes and questions

Tracking Tools

- LogTime.ai Analytics: Comprehensive multi-currency tracking and risk analysis

- Currency Risk Reports: Regular analysis of exposure and hedging effectiveness

- Client Feedback Systems: International client satisfaction with billing processes

Benchmarks

Industry benchmarks for multi-currency operations:

- Conversion Accuracy: 100% for automated systems vs. 85-90% for manual

- Payment Speed: Similar to domestic clients (15-30 days)

- Currency Risk: <5% profitability impact from currency movements

- Client Satisfaction: 95%+ satisfaction with professional currency handling

Continuous Improvement

- Monthly Currency Reviews: Assess rate trends and risk exposure

- Quarterly Client Communication: Review currency preferences and satisfaction

- Annual Strategy Optimization: Evaluate hedging strategies and pricing policies

Conclusion: Mastering Multi-Currency Time Tracking

Professional multi-currency time tracking is essential for international software development success. By implementing automated currency conversion, professional billing practices, and effective risk management, you can serve global clients while protecting profitability and maintaining strong relationships.

Key Takeaways

- Automation eliminates errors: Automated currency conversion ensures billing accuracy

- Professional presentation builds trust: Clear documentation and transparency improve client relationships

- Risk management protects profits: Currency hedging and buffers maintain profitability

- Consistent policies improve efficiency: Standardized approaches reduce administrative overhead

Your Next Steps

- Implement automated multi-currency tracking with LogTime.ai for immediate accuracy

- Establish clear currency policies and communicate them to international clients

- Set up risk monitoring and hedging strategies for currency protection

- Monitor and optimize currency operations for maximum efficiency

Why LogTime.ai Makes the Difference

LogTime.ai provides comprehensive multi-currency automation that:

- Eliminates manual conversion errors through real-time rate integration

- Provides professional documentation that builds international client trust

- Monitors currency risk and alerts you to significant rate changes

- Automates professional billing in any client currency

Ready to Get Started?

Don't let currency complexity limit your international growth. Start your free LogTime.ai trial today and experience automated multi-currency time tracking that enables global business success.

Additional Resources

- Multi-Currency Setup Guide: Step-by-step configuration for international clients

- Currency Risk Management: Strategies for protecting profitability

- International Billing Templates: Professional invoice and communication examples

- Compliance Guidelines: International tax and reporting best practices

Have questions about setting up multi-currency time tracking? Reach out to our international business specialists at support@logtime.ai - we're here to help you succeed in global markets.